We define cryptocurrency as an encrypted digital entity that operates without government or central banks’ supervision. This reality attracts more and more individuals all over the planet as they choose to pay with them. Blockchain is used by more than 300 million people, which shows us that cryptocurrency payments are becoming increasingly popular.

It’s not only Individuals who follow this trend; companies worldwide are incorporating digital currencies as payment.

With so many crypto users, its adoption creates opportunities for enterprises to enter new markets, particularly in areas where traditional financial systems are less accessible. The move to digital currencies offers substantial benefits for online businesses and represents a ten-year evolution from a specialised interest to a broadly accepted payment option. This article will discuss the factors to consider and provide a helpful how-to for businesses looking to integrate crypto payment gateway services.

Key Takeaways

- Companies that incorporate cryptocurrency payment gateways serve more than 300 million users. In addition to meeting consumer payment preferences, this adoption extends the market.

- Direct transactions between sender and recipient are possible using a crypto payment gateway by removing the need for intermediaries.

- Businesses may operate internationally without the difficulties of currency conversions or foreign exchange fees because cryptocurrencies are borderless.

- Due to blockchain technology’s ability to provide higher security and privacy, crypto transactions appeal to a broader range of customers who are worried about their online privacy.

Defining a Crypto Payment Gateway

It becomes easier to accept digital currency as payment for products and services by using a crypto payment gateway. Businesses can process cryptocurrency transactions thanks to this method. The gateway allows retailers to handle their finances without having crypto holdings on their balance sheets by instantly converting digital payments into fiat currencies.

Understanding Payment Gateways

Businesses can accept payments through crypto payment gateways and specialised payment processors. These gateways free them from dealing with digital currencies by smoothly translating crypto to fiat money.

They offer crucial services that help clients have the best possible payment experience, including wallet management, currency conversion, regulatory compliance, and technology integration.

Nodes, Miners, and Wallets

The decentralised blockchain network’s nodes monitor and verify transactions to prevent cryptocurrency double-spending. Miners generate new currencies and receive transaction fees for donating their processing power.

Customers need to connect private keys in cryptocurrency wallets to perform secret and similar transactions to PINs with public addresses that resemble account numbers. Users who own non-custodial wallets have complete control over their private keys, while a third party oversees custodial wallets.

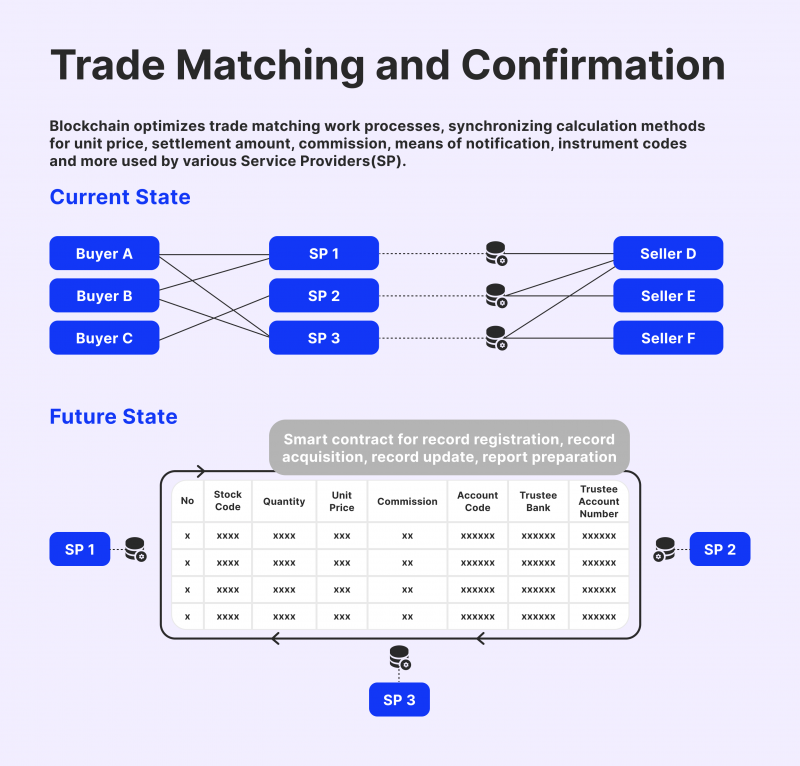

Blockchain and Cryptocurrency

Blockchain technology, a decentralised ledger system spread among multiple computers that avoids traditional financial system limitations like location and operational restrictions, is the foundation of cryptocurrencies.

Cryptocurrencies, or virtual currency traded on the blockchain, are used in transactions, and Bitcoin stands out among them as one of the most commonly used ones.

Payment services for cryptocurrencies swiftly convert virtual currencies into fiat money, encouraging the use of cryptocurrencies. They make transactions easier by enabling retailers to take Bitcoin payments without handling or storing the digital currencies themselves.

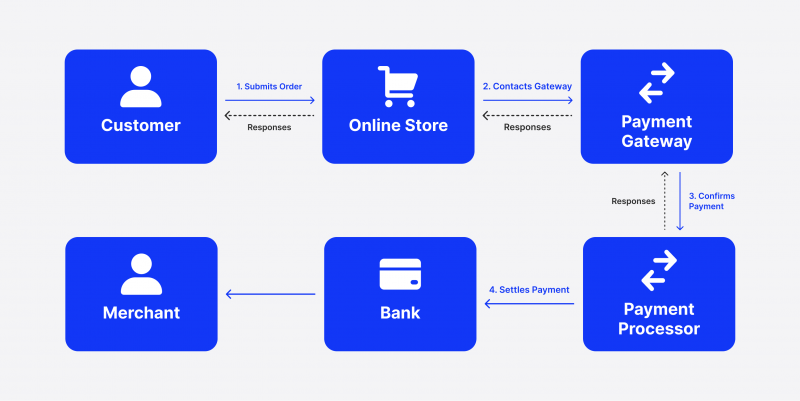

How Crypto Payment Gateways Operate

A crypto payment gateway follows a simple operation procedure. At the point of sale, customers can pay with digital currencies using an app, in-store or online. They send the amount of crypto equal to the current value of the transaction.

The payment gateway immediately converts this into the merchant’s chosen fiat currency, and the funds are deposited into the merchant’s account according to the terms of the service agreement.

This system makes real-time transaction processing possible by giving retailers more payment alternatives and improving their ability to accept cryptocurrency payments.

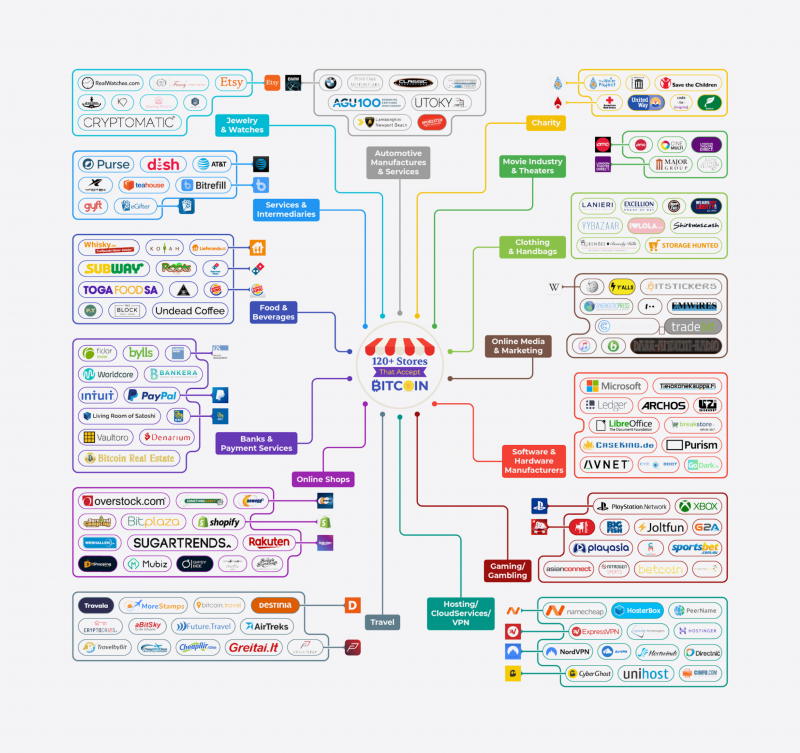

Globally, approximately 30,000 vendors now accept cryptocurrency payments from their customers, with notable companies such as Subway, Starbucks, BMW, and Microsoft.

Companies That Take Bitcoin Payments

To give clients the option of using digital currencies for payments, many industries are integrating crypto payment gateways, from e-commerce sites to tech companies. Let’s highlight some of them.

E-commerce and Retail

BigCommerce and Shopify are two online retail systems that have embraced cryptocurrency payments by collaborating with payment processors like B2binPay, BitPay, and CoinPayments. With this change, these platforms can now accept Bitcoin and other virtual currencies, making it easier to exchange products and services.

In addition, Microsoft and Overstock are well-known instances of giant retailers that adopted digital currency for e-commerce transactions, increased customer payment alternatives, and accepted Bitcoin.

Technology Sector

Well-known tech firms like Dell and ExpressVPN have integrated crypto into their payment systems. These businesses understand the importance of providing their clients with a crypto payment option to meet the demand for safe and decentralised payment systems.

Web Hosting and Services

Hostinger, Namecheap, and other web hosting companies have joined the crypto trend by taking digital currencies. This adoption demonstrates how the tech sector is moving towards more inclusive payment options that serve a worldwide clientele.

Food and Beverage Industry

The food and beverage industry has also begun accepting crypto payments, including Burger King and Starbucks. With this breakthrough, customers now have a practical payment option, which is a big step towards the mainstream acceptance of cryptocurrencies.

Various Industries Embracing Crypto Payments

Telecommunications is one of the other industries that has embraced cryptocurrencies; AT&T pioneered in this regard, accepting Bitcoin payments for its services.

Pavilions Hotels & Resorts, a representative of the premium hospitality industry, provides upscale lodging that can be paid for using Bitcoin and other cryptocurrencies, highlighting the adaptability of crypto payments to various market niches.

Online casinos and gambling businesses also adopt crypto massively, offering their clients secure, fast, and accessible withdrawals.

Expanding Crypto Payment Options

Crypto payment gateways support the use of crypto payments by making it easier to convert digital currencies to fiat money instantly. This streamlines the transaction process and frees up retailers from having to handle or hold digital currencies in order to accept Bitcoin payments.

Transactions are made safe and easy by integrating QR codes and crypto wallets, reflecting the changing nature of digital commerce and payment processing.

The fact that cryptocurrencies are widely accepted in an array of businesses suggests that they have a lot of promise as a standard payment mechanism. These cryptocurrencies give businesses and consumers innovative prospects for safe and effective transactions.

How Businesses Accept Crypto Payment

By choosing and integrating a crypto payment gateway, businesses can accept digital currency as a form of payment through structured procedures. Let’s break them down:

1. Choose a Crypto Payment Processor

Businesses should assess potential processors based on their technological capabilities, worldwide reach, compliance, costs, and processing times. The selected processor will manage the complexities of crypto transactions, encompassing prompt conversion to fiat currencies to avoid the financial implications of market fluctuations on the enterprise.

2. Integration with Business Platforms

The next stage is integrating the crypto payment gateway with the company’s website. Depending on the company’s infrastructure and the selected gateway’s capabilities, this can include anything from using hosted payment sites to putting plugins and APIs into place. Devices that work with the current point-of-sale (POS) systems may be needed to integrate crypto payments for physical establishments.

3. Optimise the Payment Experience

It is crucial to optimise the checkout process to incorporate payment choices for cryptocurrencies. This involves making sure that consumers easily choose cryptocurrencies and that the payment procedure is simple. The payment process should be as simple as possible to increase conversion rates.

4. Customer Payment Selection

Customers can select crypto at checkout once the payment system functions. After viewing the current exchange rate for the crypto of their choice and accepting it, they can continue with the payment process, which is frequently made simple by a QR code.

5. Transaction Confirmation and Settlement

After selecting the method, individuals use their crypto wallet to finalise their payments. Then, the transaction gets processed and confirmed by the blockchain. The gained crypto may be kept in the company’s digital wallet or converted to fiat money and deposited into the company’s bank account, depending on their preference.

Some Additional Considerations

- Managing crypto volatility – Businesses should be prepared for the fluctuation of cryptocurrencies by offering services like rapid conversion of crypto funds into fiat upon receipt.

- Setting up a crypto wallet or gateway – Choosing to handle received funds flexibly can be achieved by using a gateway that allows currency conversion or a straight crypto wallet for payments.

- Understanding regulations – It is essential to familiarise oneself with regional legislation regarding crypto transactions to guarantee compliance, particularly concerning tax consequences.

Pros and Cons of Accepting Crypto Payment

Now, let’s talk about the pros and cons of choosing this payment option.

Enhanced Security and Privacy

Crypto transactions offer more anonymity and security than traditional payment methods since blockchain technology safeguards and privatises transactions. Because it is decentralised, there is less need for personal data, which lowers the possibility of chargeback fraud and data theft.

Reduced Costs

The 3% to 5% middlemen expenses that are normally attached to digital payments, such as credit card fees, disappear by using cryptocurrencies. Sender-to-receiver direct transactions result in lower fees and perhaps long-term savings.

Quick Transactions

Payments with cryptocurrencies avoid the typical bank processing delays and allow for instant transfers. The speedy transfer of payments helps both customers and businesses.

Global Market Access

Businesses may function internationally thanks to cryptocurrencies’ borderless nature, which eliminates the need for foreign banking fees or currency conversion. This makes foreign markets accessible, allowing startups and small enterprises to compete globally.

Broader Customer Base

Taking crypto payments may attract clients who prefer cryptocurrencies or who are worried about their online privacy. In addition to those who use standard banking systems, it also encompasses unbanked people, so increasing the potential consumer base.

The Obstacles of Taking Payments in Cryptocurrencies

However, there are not only benefits; there might be some drawbacks to crypto payments.

User Experience

Payments using cryptocurrencies are still being developed. Although certain sectors may have high conversion rates, the industry is striving to make payments as simple as they are in traditional e-commerce transactions.

Price Volatility

The volatility of crypto prices makes it risky to hold. The majority of companies reduce this risk by using a crypto payment processor to convert to fiat money, but there is still a chance for price fluctuations.

Regulatory Compliance

Digital asset regulations are evolving, with different requirements in different places. Businesses wishing to accept crypto payments may find it uncertain, given the constant changes.

Interoperability

Technical issues arise when integrating blockchain transactions between various blockchains or with traditional banking systems. However, there are new solutions emerging on the horizon, like APIs that make transfers across different payment networks easier.

Final Thoughts

To sum it all up, integrating crypto payments into a business plan has a number of clear benefits, like meeting customer preferences for payments using digital currencies, allowing faster fund settlement, and lowering transaction costs when compared to traditional card payments.

Benefits like these can give companies competitive advantages like easier access to new markets and better cash flow management. Collaborating with a reputable crypto payment processor is the most effective approach for businesses wishing to use crypto payments. The complexities of setup, continuous management, checkout integration, settlement, and regulatory compliance are all taken care of by these partners.

Businesses don’t have to completely restructure their current finance procedures to take a range of digital currencies thanks to a reliable crypto payment gateway that facilitates smooth transactions. These platforms, which prioritise regulatory compliance and risk management, provide businesses with a safe and effective means of implementing cryptocurrencies into their payment methods.

FAQ

How does crypto benefit businesses?

The efficiency of payment processing is increased by using cryptocurrencies, which offers significant advantages for business growth. Because they do not require traditional financial service fees, cryptocurrencies are cost-effective for both people and businesses.

Why use a crypto payment gateway?

Businesses can accept payments from all around the world by using a crypto payment gateway instead of the usual financial structures.

Is crypto good for small businesses?

With the help of cryptocurrencies, small businesses may expand their consumer base and hedge against regional economic swings while having access to international markets without worrying about exchange rates or other conventional banking challenges.

Which crypto payment gateway is the best?

In 2024, the top crypto payment gateway is B2binPay. B2BinPay supports various blockchains, currencies, and stablecoins, offers quick settlements with outgoing transaction fees, a user-friendly front end, and instant swaps. It is an ultimate solution offering digital (Merchant) wallets for FinTech firms, retail businesses, gambling websites, and more, as well as blockchain (enterprise) wallets for crypto exchanges, brokerages, and other enterprise-level clients.